Risk Management and Regulatory Reporting

Waystone employs a team of experienced AIFMD risk management professionals who independently generate and analyse each portfolio’s risk analytics using RiskCore, our market-leading technology platform.

AIFMD Risk Management & Investment Compliance

Our approach to regulatory risk management and investment compliance provides investors with the confidence of truly independent risk oversight, while also providing investment managers with invaluable insight into the risk profile of their European funds:

- Risk performed without investment manager input for verifiable independence.

- Enhanced risk oversight in the areas of scenario testing, back-testing, what-if analysis, liquidity matching and monitoring in addition to the standard requirement of VAR, sector analysis etc.

- Assessment of the fund’s regulatory compliance with hard and soft investment restrictions.

- Production of enhanced regulatory reporting including sample fixed income oversight reporting.

Our proprietary liquidity risk methodology is fully compliant with European Securities and Markets Authority (ESMA’s) latest guidelines.

Fund Regulatory Reporting

As part of a comprehensive suite of regulatory fund compliance solutions, Waystone generates regulatory filings in the required format for each local financial regulator. After receiving portfolio data from the fund administrator, investment manager or other suitable parties, we will process, map and enrich the data with feeds from leading market vendors, to deliver a complete end-to-end regulatory reporting framework. As such, investment managers will receive a signature-ready filing without the burden of compiling, calculating and completing the report. Our Risk Management Team provides complete follow-up support for all regulatory fund compliance filings produced.

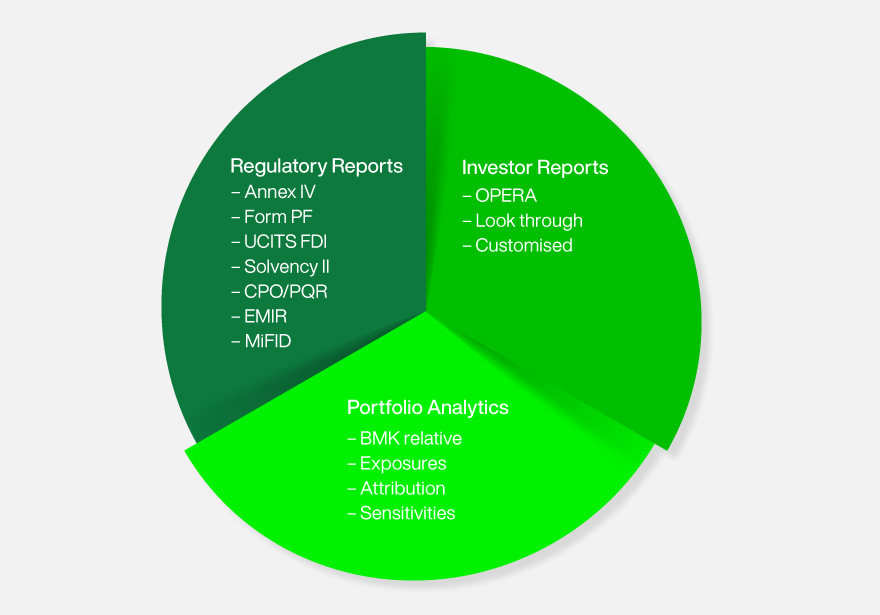

Our fund regulatory reporting services for European Funds include:

- Annex IV reporting

- European Market Infrastructure Regulation (EMIR) reporting

- Form PF regulatory filing

- UCITS Financial Derivative Instruments (FDI) report

- Solvency II Reporting

- Form CPO-PQR

- MiFID II transaction reporting/trade reporting

- Investor reports

- OPERA

- Look through

- Customised

- Portfolio Analytics

- BMK relative

- Exposures

- Attributions

- Sensitivities

Key Investor Information Document (KIID) Preparation and UCITS Website Hosting

Waystone completes the following regulatory requirements for AIF/UCITS fund management:

- Packaged Retail & Insurance-based Investment Products (PRIIPs) KID creation

- UCITS KIID/ PRIIPs KID translations (via third-party support)

- Synthetic Risk and Reward Indicators (SRRI) calculation and ongoing monitoring

- Total Expense Ratio (TER) monthly reporting

- European MiFID template creation

- KIID/ KID filings with the local responsible authority

- Hosting of UCITS KIIDs and key fund documents on the Waystone UCITS web-portal.

To learn more about our European Solutions, contact a Waystone representative today.

Risk Management & Regulatory Reporting FAQs

The purpose of AIFMD risk management is to protect investors by ensuring that AIFMs have robust risk management processes in place to identify, measure, and manage the risks associated with the AIF.

AIFMD requires AIFMs to implement an effective risk management framework that is appropriate for the size and complexity of the AIF. This includes conducting regular risk assessments, implementing policies and procedures, and monitoring and reporting on the effectiveness of those measures.

Failing to comply with these risk management requirements can result in fines, sanctions, and reputational damage.